Successfully implementing an effective RCM strategy relies on developing a cohesive framework that is to be managed. For the purposes of this discussion, I’m defining the healthcare revenue cycle to include all administrative and clinical functions that contribute to the capture, management, and collection of patient service revenue.

At a high level, the many steps of the revenue cycle process flow can be described as follows:

-

-

-

- The patient is seen by a provider (a physician, a nurse, etc.) and the visit/encounter is captured in the medical system

- Sometimes, as a matter of practice, the physician later updates their encounter details with the diagnosis billing codes.

- The encounter is routed (to the revenue cycle software module) for processing by the revenue cycle department

- The diagnosis codes that were captured at the point-of-care, if present, are reviewed or adjusted, if not they are added

- The insurance claim is prepared per the contractual parameters with supporting patient/clinical details as dictated by the specific payer

- The claim is submitted and placed in the receivable queue

- In parallel with this, a subset of claims is reviewed for audit/fraud/compliance purposes

- The claim is now in the hands of the payer and goes through an almost inverse process

- If the full claim is received within the expected period, all is good

- Otherwise the claim may be denied, partially paid, or slow to pay and there is a back-and-forth to resolve what can be done

- Sometimes the money requires investigation to reconcile with a specific claim before it can be posted.

- Phew, we’re done for this encounter, onto the next

-

-

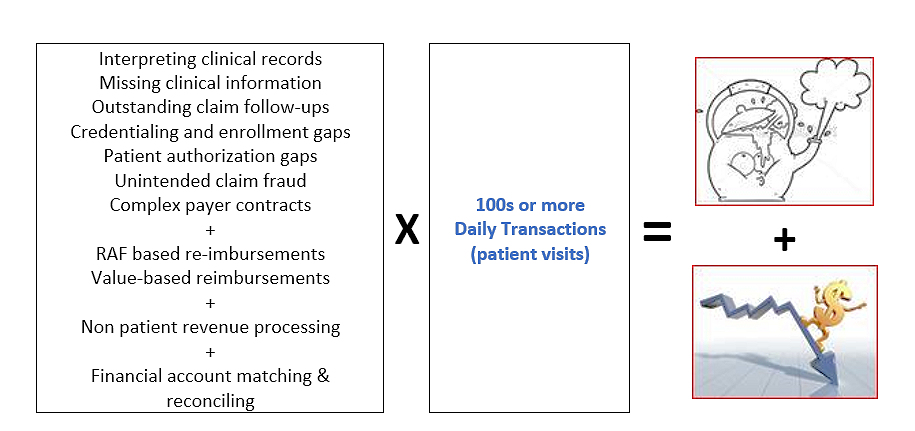

Keep in mind this process is for fee-for-service payments, never mind risk-adjusted (RAF) and value-based contract payments. You can see the storm that is overwhelming the revenue cycle department…

Data driven intelligence can help with nearly all aspects of the revenue cycle. Anything in the process from documentation and coding to charge capture, claims submission, and denials management can benefit from automation. This technology can limit human error and encourage greater accuracy while facilitating faster payment, ultimately driving revenue and improving cash flow.